hotel tax calculator bc

From 42185 to 84369. Net Amount excluding GST 9091.

Excise Taxation And Narcotics Control Department Khyber Pakhtunkhwa Government Of Khyber Pakhtunkhwa

- 5 Goods Services Tax GST levied by the federal government.

. Select hotels in Vancouver levy an additional 15 Destination Marketing Fee DMF on top of the 2 MRDT which makes a total of 35 additional taxes on some accommodation in Vancouver. A sales tax is a consumption tax paid to a government on the sale of certain goods and services. Destination Marketing Fee 200 x 15 300.

For example if your taxable income is more than 43070 the first 43070 of taxable income is taxed at 506 the next 43071 of taxable income is taxed at 770 the next 12760 of taxable income is taxed at 105 the next 21193. Amount GST Inclusive. From 84370 to 96866.

For example if your hotel is located in Vancouver which is subject to a 2 MRDT and a 15 destination marketing fee and you provide a room in your hotel for 200 per night your guest pays. Taxable and Exempt Accommodation Definitions For the purpose of PST and MRDT. Type of supply learn about what supplies are taxable or not.

Purchase Price 20000. New York State Hotel Unit Fee aka Javits Center fee 150 per unit per day. New York City Sales Tax for Hotels 45.

In British Columbia an 8 Provincial Sales Tax PST is charged on all short-term room rentals by hotels motels cottages inns resorts and other roofed accommodations. MRDT 203 x 2 406. The calculator can also find the amount of tax included in a gross purchase amount.

The rate you will charge depends on different factors see. 10015 and all amendments thereto are hereby repealed. In 2021 British Columbia provincial government increased all tax brackets and base amount by 1 and tax rates are the same as previous year.

Kelownas DMF may be 15. Hotels motels resorts boarding houses rooming houses and bed and breakfast establishments. Usually the vendor collects the sales tax from the consumer as the consumer makes a purchase.

Initial amount. In that case the GST will be calculated as follow. MCTD Metropolitan Commuter Transportation District sales use tax 0375.

Who the supply is made to to learn about who may not pay the GSTHST. Rates are up to date as of June 22 2021. A tax rate increase will only take effect after an application has been approved by regulation.

The basic personal tax amount CPPQPP QPIP and EI premiums and the Canada employment amount. From 0 to 42184. 8 rows Income Tax Calculator British Columbia 2021.

This is greater than revenue from BCs corporate income tax and property tax combined. GST Rate Add GST-Remove GST. The global sales tax for Bc is calculated from provincial sales tax PST BC rate 7 and the goods and services tax GST in Canada rate 5 for a total of 12.

Campsite and RV site bookings are exempt from any PST. Hotel Room Rates and Taxes. Some items such as food and books are exempt this tax.

Press Calculate and youll see the tax amounts as well as the grand total subtotal taxes appear in the fields below. If you choose the simplified method claim in Canadian or US funds a flat rate of 23meal to a maximum of 69day sales tax included per person without receipts. Use our Income tax calculator to quickly.

For example if you got an upgraded room of 8000 28 slab but you need to pay only 6000 for that. GST Includes Tax. If the upgrade in the room is provided at the lower rate then Gst will be calculated according to the upgraded room.

This bylaw may be cited for all purposes as City of Kelowna Hotel Tax Bylaw No. It winds up being a little less than 15 350 per day. - 3 city levy is charged on hotel motel and resort accommodations in Kelowna.

Where the supply is made learn about the place of supply rules. Ad Get Reliable Answers to Tax Questions Online. On April 1st 2013 the government removed the HST and replaced it by provincial sales tax PST and GST in British-Columbia.

Province of Sale Select the province where the product buyer is located. To calculate the subtotal amount and sales taxes from a total. Some communities such as Downtown Victoria have an additional Destination Marketing Fee of 10 which I believe is voluntary.

Net amount GST amount Gross amount. Although you do not need to keep detailed. These calculations are approximate and include the following non-refundable tax credits.

If you choose the detailed method to calculate meal expenses you must keep your receipts and claim the actual amount that you spent. Revenues from sales taxes such as the PST are expected to total 7586 billion or 225 of all of BCs taxation revenue during the 2019 fiscal year. BC Revenues from Sales Taxes.

Hotels in most parts of BC will be 15 5 GST 8 PST short term accommodaton only 2 MRDT formerly known as Hotel Tax. In most countries the sales tax is called value-added tax VAT or goods and services tax GST which is a different form of consumption tax. The following table provides the GST and HST provincial rates since July 1 2010.

NYC Hotel Room Occupancy Tax Rate 2 per room 5875. Our GST calculator will calculate the amount of GST included in a gross price as well as the amount you should add to a net price. - 7 Provincial Sales Tax PST levied by the province.

Certified Public Accountants are Ready Now. Tax rates are applied on a cumulative basis. Sales taxes make up a significant portion of BCs budget.

The PST for other goods and services is set at 7. 2 Municipal and Regional District Tax MRDT on lodging in 45 municipalities and regional districts. Our sales tax calculator will calculate the amount of tax due on a transaction.

GST 28 of 6000. The City of Kelowna Additional Hotel Room Tax Bylaw No. GST 5 PST 7 on most goods and services.

Currently the following tax rates apply. Goods and services tax GST calculator online. Upgrades At Lower Rates.

Goods and Services Tax GST Calculator. PST 203 x 8 1624. After-tax income is your total income net of federal tax provincial tax and payroll tax.

Accommodation includes lodging provided in. Base amount is 11070. Current GST and PST rate for British-Columbia in 2021.

This bylaw shall come into full force and effect and is binding on all persons as of January 1 2014. Ensure that the Find Subtotal before tax tab is selected.

How To Calculate Gross Rent Multiplier Uses For Investors

Mortgage Formula Cheat Sheet Home Loan Math Made Simple Mortgage Loans Mortgage Rates Today Types Of Loans

Excise Taxation And Narcotics Control Department Khyber Pakhtunkhwa Government Of Khyber Pakhtunkhwa

Under Armour Face Mask Withdrawn From Sale Due To Potential Safety Concerns Which

Second Hand New International Tax Advisor Tax Advisor Post Free Ads Advisor

Tax Season Filing Dos And Don Ts To Keep In Mind Department Of Revenue City Of Philadelphia

What Does Net Hst Included Mean What The Sooke

How To File Taxes In Canada As A Freelancer Step By Step Guide

Operating Income Overview Formula Sample Calculation

Eur Lex 52019sc0341 En Eur Lex

Guide To Buy Pre Construction Condos In Toronto Wowa Ca

Manitoba Gst Calculator Gstcalculator Ca

Jual Pulsa Dan Kartu Perdana Akan Dikenai Pajak Malang Post News

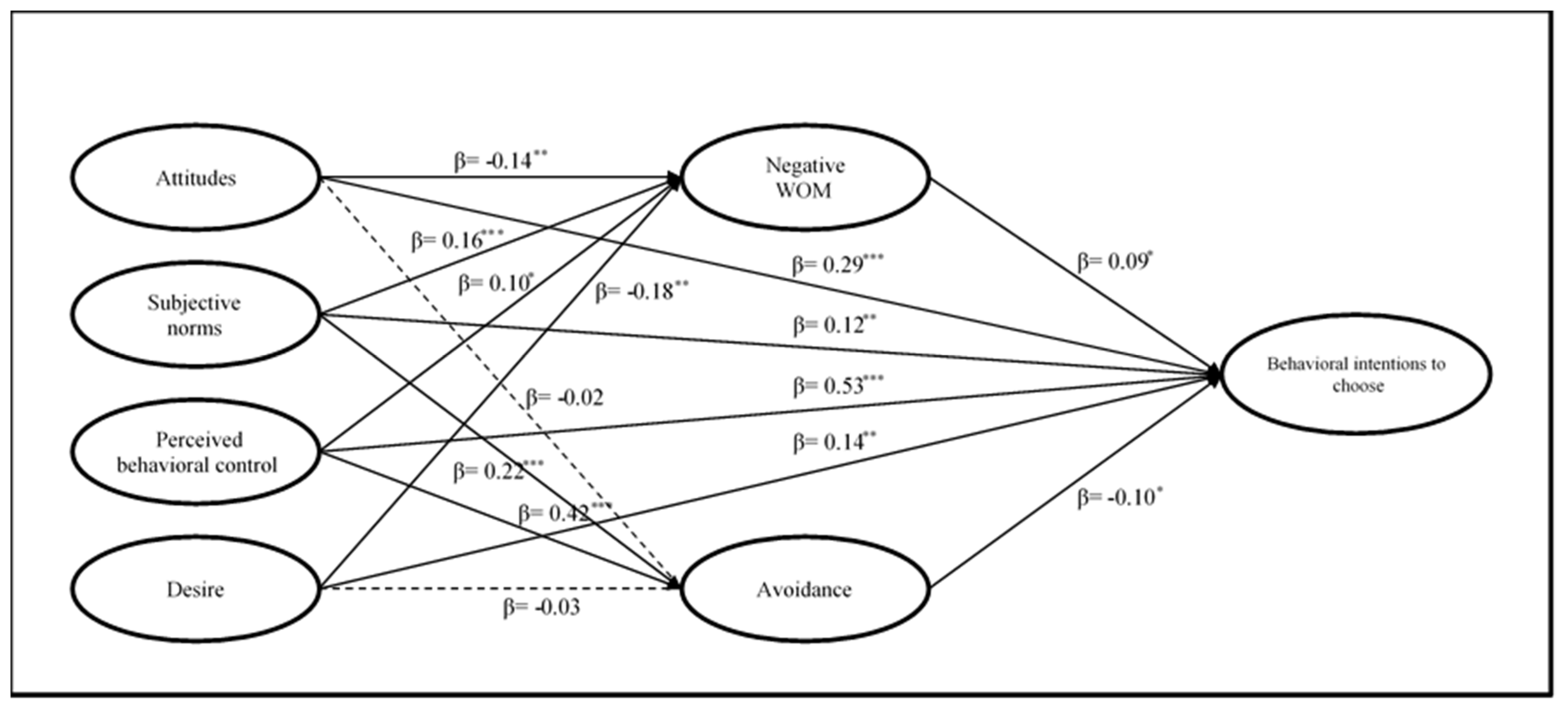

Sustainability Free Full Text Factors Predicting Individuals Behavioural Intentions For Choosing Cultural Tourism A Structural Model Html

Florida Property Tax H R Block

Tax Year 2021 Irs Forms Schedules Prepare And File

Excise Taxation And Narcotics Control Department Khyber Pakhtunkhwa Government Of Khyber Pakhtunkhwa