r&d tax credit calculation software

Use our simple calculator to see if you. Compare the Top Tax Software and Find the One Thats Best for You.

Tips For Software Companies To Claim R D Tax Credits

NeoTax Prepares a Study and Filing Instructions for Your CPA.

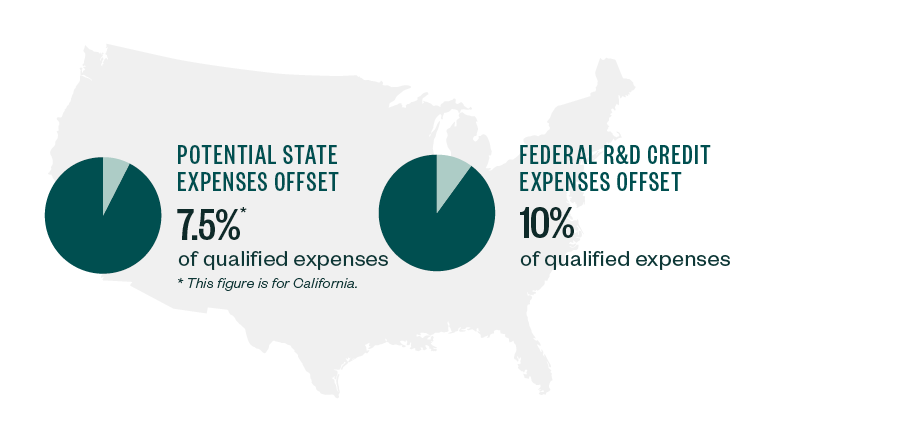

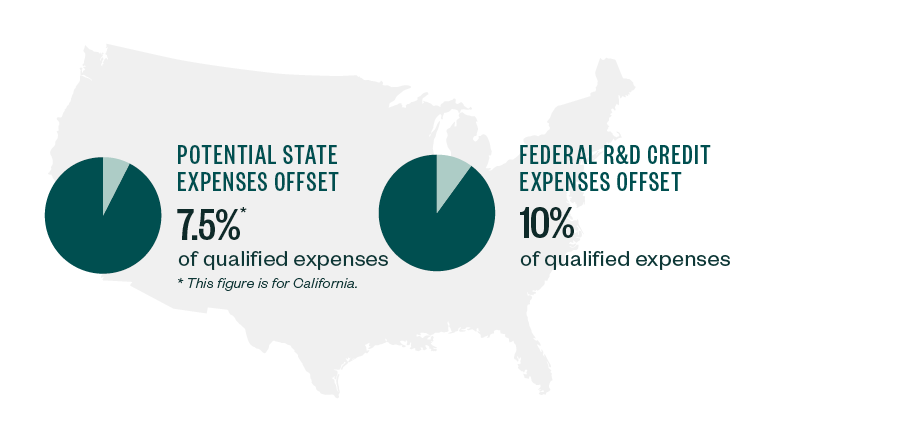

. Fifty percent of that average would be 24167. How to calculate the RD tax credit using the traditional method RD tax credit calculation using the traditional method is based on 20 of a companys current year QREs over a base amount. What is the RD tax credit worth.

To reduce their tax liability substantially. RD Tax Credit Calculator. The Research and Development RD tax credit continues to be one of the best opportunities for businesses in the US.

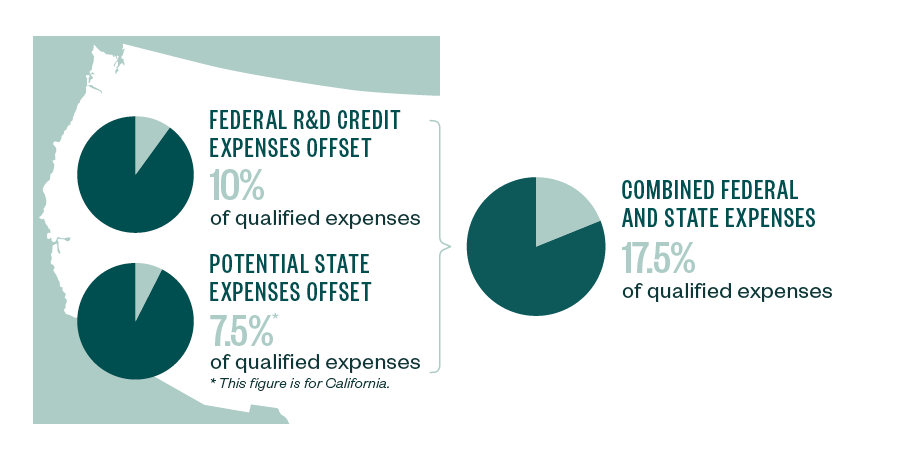

Ad Determine If Youre Eligible To Claim The 2020 RD Tax Credit With Our Fast Easy Process. This is a dollar-for-dollar credit against taxes. In addition to the federal credit many states offer tax breaks.

Estimate your Federal and State RD Tax Credit with our FREE Tax Credit Calculator. Prepare Your RD Credit Get Cash Back. Up to 65 of expenses for contract RD may be included in the credit calculation provided that the work is performed in the United States or US territories.

Sigma Tax Pro Best-in-Class Technical Tax Prep Support For 1040 1120 Form Preparation. NeoTax Prepares a Study and Filing Instructions for Your CPA. Qualifying expenditures generally include.

Congress has enacted powerful government-sponsored incentives that can significantly reduce your companys current and future years federal and state tax. Software for new projects or new functionality for existing RD projects. The RD Tax Credit provides opportunities for software companies of all sizes in almost any industry to offset tax liabilities.

Residential Cost Segregator 481a Adjustment Calculator. Our Research Credit Solution RCS makes it easy. ProSeries time-saving features make it easy to use from anywhere at any time.

For most companies the credit is worth 7-10 of qualified research expenses. The RD tax credit is available to companies developing new or improved business components including products processes computer software techniques. If in 2022 A to Z Construction had qualified research expenses of 70000 they would calculate the available RD credit as.

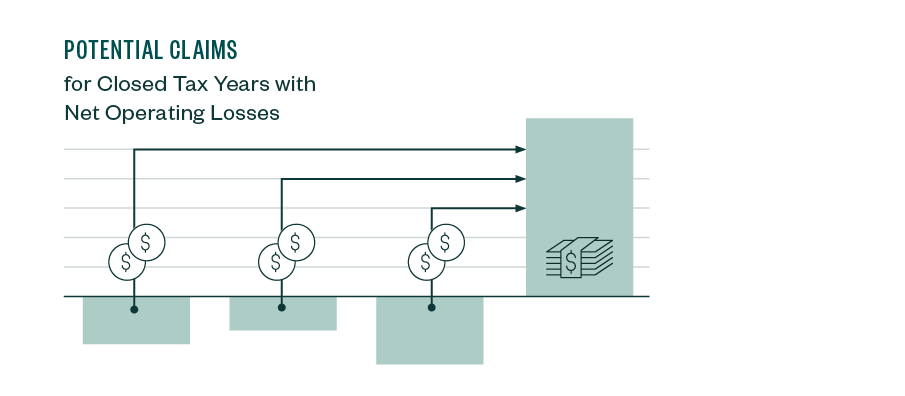

Follow up and gather more documents from anywhere. According to the Joint Committee on Taxations JCT most recent tax expenditure report the RD tax credit will reduce tax revenue by about 118 billion in 2020106 billion. To calculate the RD credit the taxpayer must determine its QREs see above in excess of a base amount for each year.

Prepare Your RD Credit Get Cash Back. Ad Learn Why Financial Services Companies are Making Changes to Their Tax Operating Model. Companies spend significant time and effort collecting data and aggregating the necessary documentation to support.

RD Tax Credit Calculation. By answering a series of simple questions our RD tax credit calculator allows you to estimate your potential claim value whether youre due a tax reduction or a cash credit. Ad Leading Professional Tax Software Best In Class Technical Support With Sigma Tax Pro.

The federal research and development RD tax credit results in a dollar for dollar reduction in a companys tax liability for certain domestic expenses. Ad Your Business Could Save Up To 250000 Through The RD Tax Credit. Its easy and free.

Ad Early Stage Startups Can Claim the RD Tax Credit. Estimate Your RD Tax Credit. Before you can calculate the amount you receive in RD tax credit carryforward youll need to ensure that your business is located in the US and pays tax.

Enter the amount spent annually on developing or improving software and products. The term base amount is defined by multiplying the fixed-base. R.

RD Tax Credit Calculator. How to Use the Strike RD Tax Credit Calculator. See If Youre Eligible To Claim A RD Tax Credit.

Pilot Helps You Maximize Your Savings While Doing The Heavy Lifting. Use Titan Armors calculators to estimate your state and federal RD tax credit benefits or to see if you can offset your payroll tax. Tracks time and automatically sends surveys to clients.

The results from our RD Tax Credit Calculator are only estimated. Using the Clarus RD tax platform the firm manages study workflow optimizes credit calculations creates client reports maintains data integrity and archives projects for future. These are categorized under.

Because of its technological nature the field of software development is ideal for federal research and development RD tax creditsIf youre a software developer RD tax credits can. Cost Segregation Savings Calculator. Some common examples of the types of software development projects that usually qualify for RD tax relief include.

Leading Class Tax Tools and Technology to Help Businesses Stay Competitive. Research and development R. Ad See the Top 10 Ranked Tax Software in 2022 Make an Informed Purchase.

Ad Early Stage Startups Can Claim the RD Tax Credit. The RD Tax Credit is an incentive credit for entrepreneurs under section 41 of the Internal Revenue Code that is headed as 26 US. Ad ProSeries is fueled by 1000 error-finding diagnostics and saves you time on every return.

They reimburse companies that. If You Dont Qualify You Dont Pay. The credit benefits large and small companies in virtually every industry yet our research shows many businesses are leaving money on the table.

Tips For Software Companies To Claim R D Tax Credits

The R D Four Part Test Rd Tax Credit Software

Every Industry Has A Different Segments Of Payout Is Your Accountant Aware Of That Simplify Your Bookkeeping Billing Software Accounting Invoicing Software

R D Tax Credits For Software Development Are You Eligible What Projects Qualify

![]()

Timesheet Software For R D Tax Credits Replicon

Tips For Software Companies To Claim R D Tax Credits

R D Tax Credit For Software Development Leyton Usa

![]()

Timesheet Software For R D Tax Credits Replicon

Tips For Software Companies To Claim R D Tax Credits

Software Development Industry Tax Credits R D Tax Credit

Upcoming Changes To The R D Tax Credit

New Home Rd Tax Credit Software

Tips For Software Companies To Claim R D Tax Credits

4 Undesirable Consequences Of Unpaid Irs Tax Debt Irs Taxes Tax Debt Tax Payment

Advantages Of Using Accounting Software Zoho Books

Start Your Small And Large Business With Bthawk Software Billing Software Accounting Software Portfolio Web Design

Erp For Growing Companies Sme Smallbusiness Ocean Systems Business Business Process